TaxAct 2022 review: Affordable online tax filing with a personal touch

TaxAct

The best software will never take all the pain out of tax filing, but it may come pretty close.

Reporting your 2021 taxes will become more complicated this year with things such as new kinds of tax credits for sick leave related to COVID-19, and small-business grants related to the pandemic if you run a business.

Some of that complexity can be smoothed over by using the very capable tax reporting package, TaxAct, by the software maker of the same name.

The program can take you through the questions and answer process of adding up your income, your expenses, and your special deductions, and then either electronically file for you, or print your forms for you to mail in.

Some tax forms are not finalized and may not be for another month, but TurboTax will let you get very far along in the process in just a couple of hours. That is, assuming that you have at least a rough idea of what is going to show up on your W-2s and 1099s, and what your expenses are.

There’s an extra incentive to get started now, which is that TaxAct is offering its live human CPA assistance, Xpert Assist, for free if you file by March 31.

Like

- Solid handling of the essentials of filing, even for self-employed, plus free live advice from CPAs and a good mobile app.

Don’t Like

- Some of the language in the online version about the details of tax rules could be made more user-friendly for those less experienced in the nuances of tax jargon.

The offerings

TaxAct has essentially three categories of products: online, through a Web browser; Xpert Assist, the human-assisted version where a CPA will field questions online and also chat with you by phone; and the old-fashioned download route, where you get a desktop app that runs outside the browser.

The prices range from free online, to up to $139.95 for the self-employed downloadable software option that will handle things such as 1099s. State filings are extra for all the online products, at $34.95 to $44.95 per state filing. All the downloadable software products above the “Basic” version come with one free state filing, plus $50 for an additional state filing. There is also a “multi-state” add-on to the downloadable products, that will let you prepare multiple state documents, for $100.

The Xpert Assist function adds another $50 to $75 to the final price of the online products. However, at the moment, Xpert is being offered for free on all products, that it would otherwise be an add-on cost of $59 or more, but that’s subject to change.

Also: Best tax software 2022: Self-employed and SMB options

Bear in mind, TaxAct has add-ons that you can purchase as an à la carte offering, including an “E-File Concierge” that keeps track of your filing status, and an “audit defense” that will enlist an “audit professional” if such an event befalls you. The company charges multiple fees for these, and in the course of filling out your online package, you will be incentivized to consider buying the multiple parts together as what’s called “All-Inclusive,” which comes out to $114.95, half the price of adding them à la carte.

In addition to the main programs, TurboTax has mobile apps for iOS and Android, TaxAct Express. These allow you to pick up where you left off with the online version, and do all the same work from your phone or tablet. A nice feature of the mobile app is the ability to snap a picture of your W2 form, if you have one, to have that automatically populate the forms.

Remember that when you are ready to file, there is an option to choose to have the cost deducted from your refund in cases where you are entitled to a refund.

The online experience

The online products, including the Xpert versions, let you start out your work without any charge, and pay only when you file. The free product is free to file except for the state filing charge.

The online versions whisk you right into the process once you click on which of the four versions you want to use, Free, Deluxe, Premier, or Self-employed.

If you are a returning user, the program will prompt you to log in with a previously established user ID and password.

The program beings, sensibly enough, by asking how you filed in past, or if you filed at all, a set of choices on the first screen. The program will then move you through the straightforward matter of entering marital status, name, social and cell phone, and address, and then on to answering broad questions about whether you have capital gains to report or charitable donations.

Also: Your home office tax deductions checklist

TaxAct will ask if you want to disclose your filing data to its sister company, TaxSmart Research LLC, which promises to give you a “personalized tax-filing experience next tax season,” but also to send you ads for new products. You can skip this if you want.

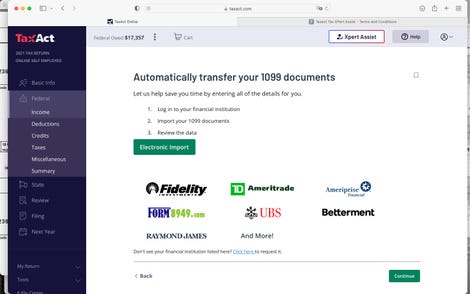

TaxAct does a good job of guiding you through the steps of recording W2 or 1099-NEC income, and expenses. In particular, TaxAct doesn’t automatically ask you to itemize every single category of expense. So, for office supplies, you can just enter a total dollar amount rather than itemizing each thing such as printer toner and paper clips. The overall effect is to streamline the deduction of itemized expenses.

The only downside to the process is that some of the language used on the Web site could be clearer.

For example, when dealing with purchases of office equipment for a small business, such as a computer, one has a choice of either depreciating the computer as an asset, which means only counting part of its value in any one year, or, instead, taking the whole value of the purchase in this year’s filing as a one-time expense. The latter is known as the “De Minimus Safe Harbor” exception. TaxAct explains this, but in somewhat stilted accounting jargon.

The Xpert feature is available on each screen as a button in the upper-right corner of the Web page. That will let you chat with someone during the hours of operation, Monday through Friday, 8 am to 5 pm, Central Standard Time. The company is currently offering that feature for no extra charge, in contrast to the extra price usually attached for Xpert help.

Conclusions

TaxAct’s online offerings are cheaper than similar offerings such as TurboTax, excluding the cost of state filings. The program delivers fairly effortless preparation in its online program. For those who have a little bit of experience with their own profit and loss over many years, and a general familiarity with tax rules, the program is a good solution to quickly breeze through putting together a filing.

The ability to call upon a CPA with the click of a button is a nice addition to a solid offering, and making it free for early filers is a smart move on the company’s part to feature this standout capability.

The mobile app does a very good job as a companion to the online program on a smartphone or tablet.

On the downside, for some less-experienced tax filers, clearer language on each Web page would help to explain some of the ins and outs of filing, things such as expensing versus depreciating property.