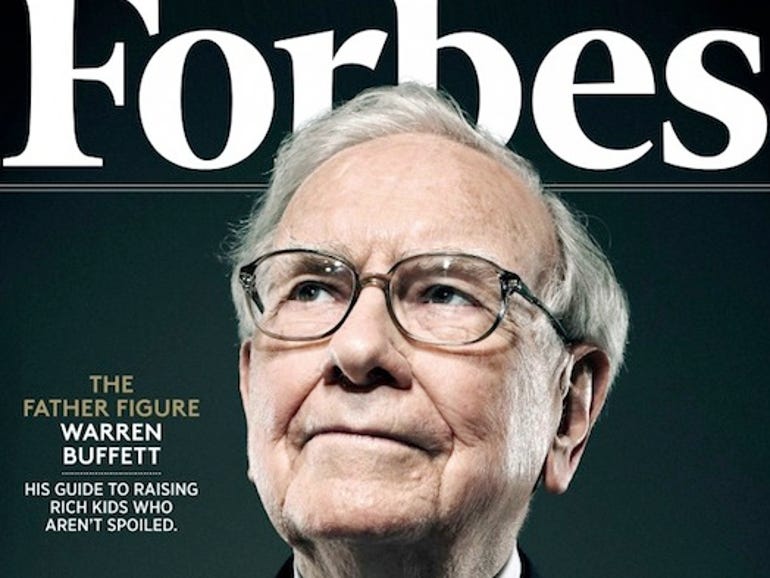

Binance invests $200 million in Forbes

Crypto giant Binance announced on Thursday that it is investing $200 million into 104-year-old publisher Forbes. The deal is part of a larger effort by Forbes to become a publicly traded company.

The transaction will see Binance chief communications officer Patrick Hillmann and head of Binance labs Bill Chin join Forbes nine-person Board of Directors this quarter.

Changpeng Zhao, founder and CEO of Binance, said they hoped to bolster Forbes’ digital initiatives “as they evolve into a next level investment insights platform.”

“As Web 3 and blockchain technologies move forward and the crypto market comes of age we know that media is an essential element to build widespread consumer understanding and education,” Zhao said.

Forbes previously announced that it was pursuing a business combination with special purpose acquisition company Magnum Opus that would allow it to go public and be traded on the New York Stock Exchange under the ticker symbol “FRBS.”

The combination is expected to close during Q1 of 2022, and Forbes said going public would enable it to “further capitalize on its successful digital transformation, using technology and data-driven insights to create more deeply engaged audiences, and associated high-quality and recurring revenue streams.”

“Forbes is committed to demystifying the complexities and providing helpful information about blockchain technologies and all emerging digital assets,” said Forbes CEO Mike Federle. “With Binance’s investment in Forbes, we now have the experience, network and resources of the world’s leading crypto exchange and one of the world’s most successful blockchain innovators. Forbes, already a resource for people interested in the emerging world of digital assets, can become a true leader in the field with their help.”

The investment from Binance will come through the blockchain platform’s “assumption of subscription agreements representing $200 million of commitments in the $400 million private investment in public equity that was previously announced alongside the news about Forbes’ deal with Magnum Opus.”

“With Binance assuming existing PIPE commitments, the overall size of the PIPE will remain at $400 million, and Binance’s investment will be according to substantially the same terms as the existing PIPE investors,” the companies explained.

“The transactions with Magnum Opus and Binance are expected to help Forbes maximize its brand and enterprise values and use its proprietary technology stack and analytics to convert readers into long-term, engaged customers of the platform, including through memberships and recurring subscriptions to premium content and highly targeted product offerings.”

Forbes is well known for its lists of the world’s richest people but has sought to diversify its business in recent years. Bloomberg News reported last month that Zhao has quickly become one of the richest crypto billionaires in the world with a net worth of $86 billion.

Binance actually sued Forbes in 2020 over an article reporting that the company created “an elaborate corporate structure designed to intentionally deceive regulators and surreptitiously profit from crypto investors in the United States.” Reporters from the outlet obtained what they called the “Tai Chi document” that explained to senior Binance executives how the company planned to get around US regulators.

Binance eventually dropped the lawsuit last year. Zhao noted on Twitter that he planned to respect the editorial independence of Forbes.

1/Had some questions in my DMs. Forbes editorial independence is and will always be sacrosanct. The strength of the Forbes brand and our investment depends on that continued independence.

— CZ ? Binance (@cz_binance) February 10, 2022

“Forbes editorial independence is and will always be sacrosanct. The strength of the Forbes brand and our investment depends on that continued independence. We’re a blockchain company and our investment in Forbes is to help them build Web3 infrastructure in the coming years,” Zhao said.

“Like many fast-growing, innovative companies, Binance is used to media scrutiny. That’s a necessary reality when you are the leader of a disruptive industry.”