Stocks slide on Fed rate hike fears, Ukraine tensions | Financial Markets News

United States stocks opened lower on Monday as investors who are already rattled by fears that the US Federal Reserve could hike interest rates aggressively also keep a close watch on the standoff between Russia and the West over Ukraine.

Wall Street has had a bad case of being whipsawed in recent weeks as investors grapple with the unwinding of the Fed’s cheap money policies that helped swell prices of stocks and homes during the coronavirus pandemic – but have also fed consumer price inflation, which is running at a 40-year high.

Adding to those worries: On Monday morning, Federal Reserve Bank of St Louis President James Bullard made hawkish remarks on the course of interest rates during an interview with business news network CNBC. Bullard stood firm on his call for a 100 basis point hike by June.

Beyond the Fed, the ongoing impasse between Moscow and Washington over Ukraine is also sowing uncertainty into the market outlook.

The Dow Jones Industrial Average dropped for a third straight day. As of 11:04am ET (16:04 GMT), it was down 0.89 percent to 34,429.78.

The broader S&P 500 index – a proxy for the health of retirement and college savings accounts – was down 0.50 percent to 4,396.37. The tech-heavy Nasdaq Composite Index was up 0.27 percent to be at 13,827.92.

What a year and it’s only February

US stocks have been gripped by volatility this year. The Nasdaq is down 11.8 percent this year alone.

On Monday, the CBOE Market Volatility Index, also known as Wall Street’s fear barometer, was up to its highest level in nearly three weeks.

Mega cap growth firms that outperformed since the coronavirus pandemic hit in 2020 have hit a bit of a wall on Wall Street.

Apple Inc, Microsoft Corp, Alphabet Inc and Tesla Inc are struggling to keep up with the gains they’ve made in the last two years. Facebook owner Meta Platforms Inc plummeted over 20 percent last week after releasing its earnings report.

Also last week, the US reported worsening price pressures despite efforts to curb soaring inflation. Consumer price inflation soared at an annual rate of 7.5 percent – its highest in 40 years. On a monthly basis, the consumer price index (CPI) – which measures price changes in a basket of goods and services – increased 0.6 percent in January compared to December.

Investors and traders are now betting for a half-point rate hike at the Federal Reserve’s meeting next month to rein in those soaring prices.

Goldman Sachs raised its Fed forecast last week to seven consecutive 25 basis point rate hikes at each of its meetings in 2022. The previous forecast was five hikes for the whole year.

Ukraine crisis: Will diplomacy prevail?

Stocks did bounce prior to the opening after Russian Foreign Minister Sergey Lavrov told President Vladimir Putin that Moscow would continue along the diplomatic path in its efforts to make a deal with the West on the Ukraine crisis.

The US has issued repeated warnings of an imminent Russian invasion of Ukraine – a move Putin continues to deny.

Economists warn that a full-on conflict and severe sanctions towards Russia would create a more polarised international arena and give the global economy (and its already-wobbly recovery from the pandemic) another punch to the gut.

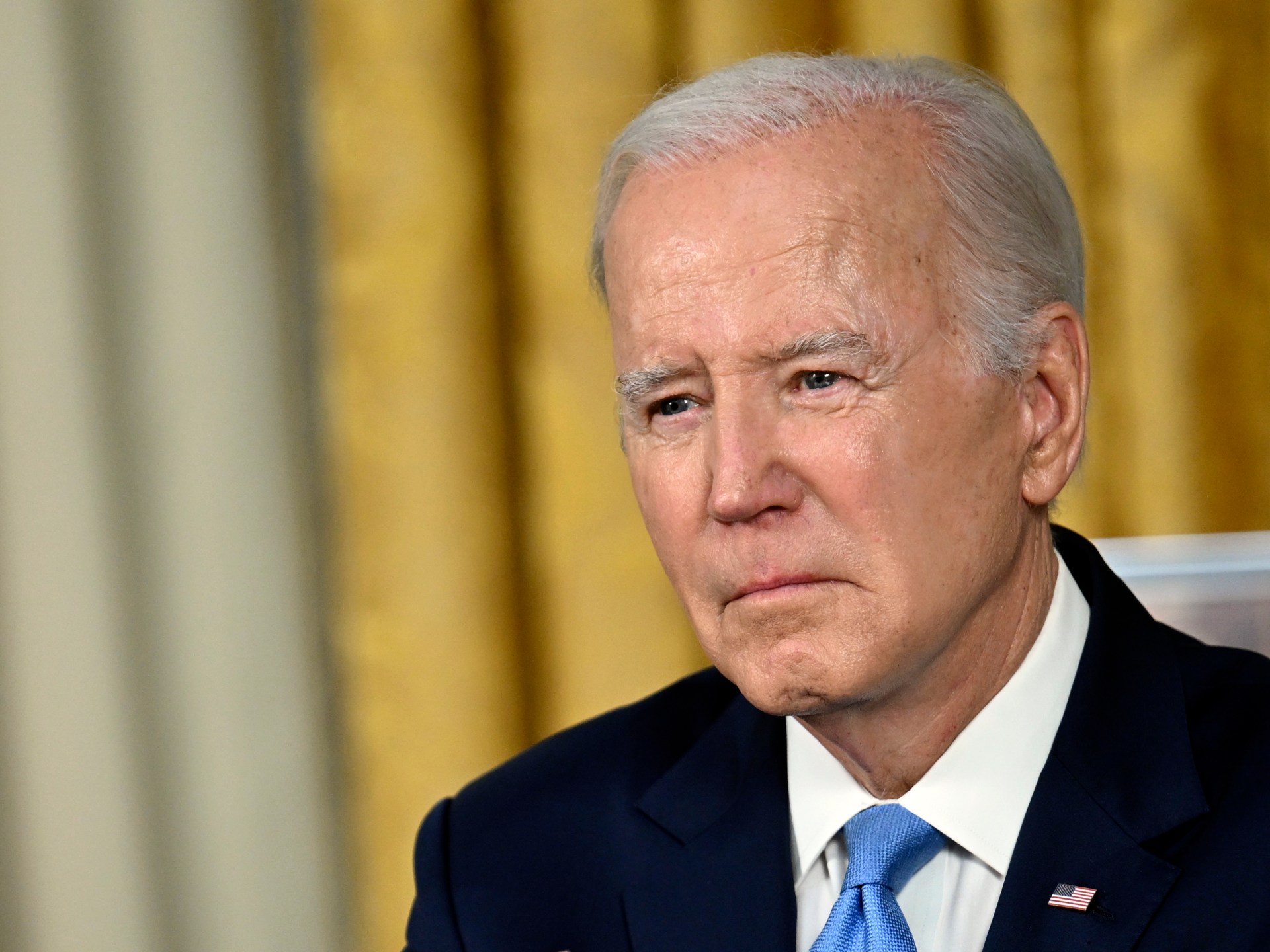

Russian President Vladimir Putin held a meeting with Foreign Minister Sergey Lavrov on Monday on diplomatically resolving the Ukraine crisis [File: Aleksey Nikolskyi/Kremlin via Reuters]

Russian President Vladimir Putin held a meeting with Foreign Minister Sergey Lavrov on Monday on diplomatically resolving the Ukraine crisis [File: Aleksey Nikolskyi/Kremlin via Reuters]For one, oil could hit $100 a barrel driven by growing demand and continued supply tightness, Rystad Energy said in a note Monday morning.

And for Europe, which was already grappling with historically high energy prices, things could get worse. A conflict and more sanctions would add as much as 2 percent to inflation, research think-tank Capital Economics warned.

“Given the inflationary backdrop and hawkish signals from central banks, monetary policy could be tightened more aggressively as a result,” Simon MacAdam, a senior global economist at the firm, warned in a note.

‘The slowdown the economy needs’

Economists at Goldman Sachs also say that Wall Street’s sensitivity to economic data has increased in recent months — particularly on days when price and wage numbers are released.

“We continue to believe more tightening in financial conditions will likely be required to generate the slowdown that the economy needs,” Spencer Hill, a senior economist at Goldman Sachs, said in a note to investors on Sunday night.

“Above-target inflation, slowing growth, and higher levels of the fed funds rate are all associated with increased data sensitivity, and we expect all three this year,” he said.