New VC firm Baukunst spools up to invest in ‘creative technologists’ – TechCrunch

Aptly, Baukunst — named after the German word for “the art of building” — is looking to invest its freshly raised fund into founders who are “elevating the art of building.” The firm is leaning into its concept of “creative technologists,” which it describes as the intersection in the Venn diagram of visionary thinkers at the forefront of cultural and societal change, and technologists who don’t shy away from being at the bleeding edge of where tech is moving.

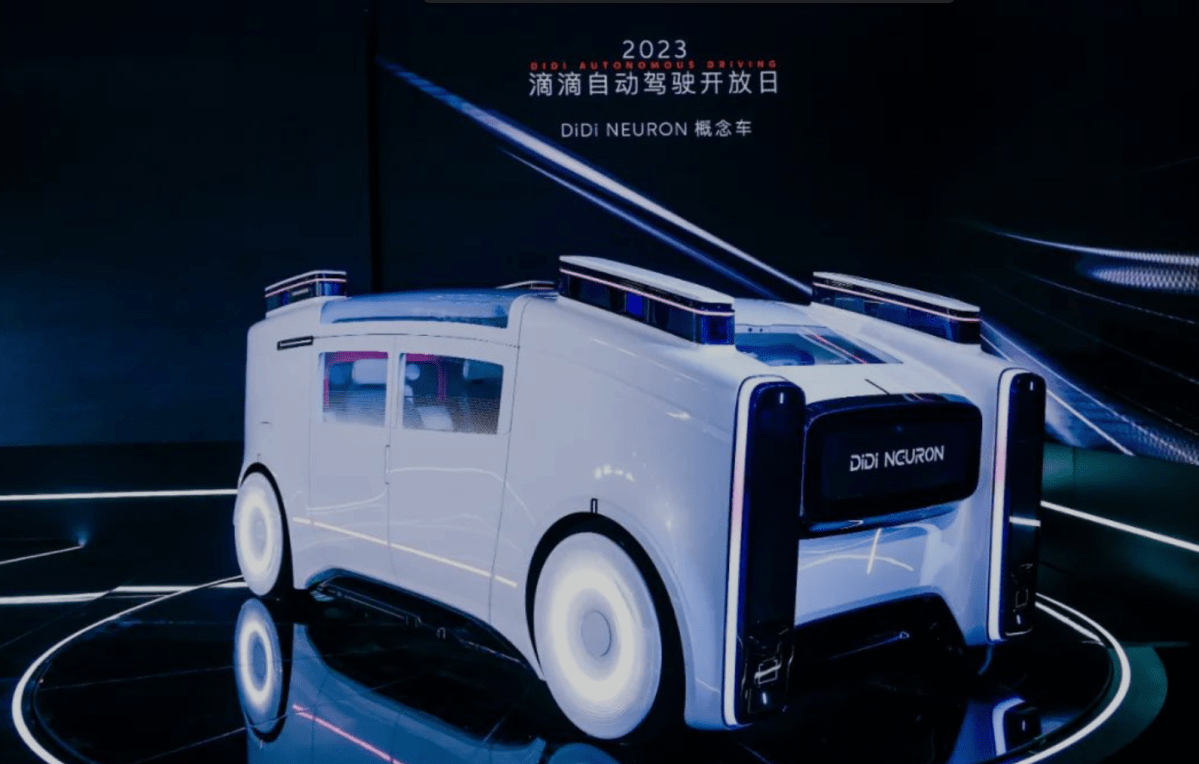

The “cultural change” Baukunst is referring to is the big shift of Gen Z joining the workforce and decision-making power shifting toward the millenial generation. It also highlights collaborative and remote work, erosion of trust in large institutions and the attention economy. Finally, the firm is keeping an eye on how customer demand is shifting in response to climate change and other big societal shifts. On the technology side, the firm is particularly interested in companies that are leveraging toolkits and shifts in computing capacity, including the ubiquitous availability of cloud-based AI, blockchain and crypto protocols, and the proliferation of edge computing and — on the hardware side — the availability of system-on-a-chip systems making AI & ML technologies available in every device. Baukunst also has a specific interest in manufacturing, supply-chain, mass customization and the availability of cheap and capable sensors that makes the next-generation IoT solutions easier and faster to develop and deploy.

The sweet spot for Baukunst is founders building first-generation technologies and products that enable the exploration of new business models. The firm is particularly eager to re-imagine modes of production by transforming how startups design, manufacture and move objects around the world. If that sounds like a pretty broad investment thesis, you’re not wrong, but the red thread in all of this is companies that are tackling big challenges across a broad range of industries.

“Baukunst is a selective ecosystem of founders, investors, and domain experts coming together to elevate our culture of creation,” explains one of the firm’s general partners, Kate McAndrew, in its announcement. “We specialize in doing new things well and welcome people, products, and companies that don’t easily fit into existing boxes.”

The firm leans deep into its Creative Technologist brand, including creating an advisory panel of experts it refers to as its “Creative Technologist Council,” many of whom are investors in the venture fund. The firm indexes highly on teamwork over solo work — or “ecosystem over egosystem,” as it likes to describe it.

Baukunst’s general partners: Axel Bichara, Kate McAndrew, Matt Thoms and Tyler Mincey. Image Credits: Baukunst

“We believe individual genius is over-represented and the complex power of scenes is undervalued. This lies in stark contrast to the egocentric, genius obsession that permeates western technology culture today. In typical startup mythos, the individual is at the center,” explains McAndrew. “Everyone knows the founders but overlook the first ten employees. We always hear about the lightbulb moment, rarely the stories of execution. We’re told of new disruptive tech emerging from isolation in a founder’s head, not evolving from deep interconnectedness with the world around it. You don’t get Horses without the love story between Patti Smith and Robert Mapplethorpe, or the ability to trade art for rent at the Chelsea Hotel. You don’t get Apple without the Homebrew Computer Club.”

In a nutshell, the firm argues that without a rich community of interdisciplinary experts, you don’t get the magic of Black Mountain College, Xerox PARC — or Bauhaus.

The firm’s GPs have an illustrious history of investing in some inspiring companies. The new fund is a reboot of sorts of venture fund Bolt, which started its life as a hardware investor complete with machine/prototype shops and office spaces in Boston and San Francisco. Eagle-eyed VC stalkers will have noted that Bolt’s third fund portfolio has a lot of investments that aren’t strictly hardware, and it’s not surprising that there was space for a new firm to pick off where Bolt left off. The team is eager to point out that Baukunst is a whole new thing, rather than Bolt 2.0. Nonetheless, its website lists a number of Bolt portfolio companies (including Tonal, Bobbie, Fyto, Pair, Fi, Spyce, Aluna and Desktop Metal) as its investment experience, muddling the message somewhat.

The new firm is choosing an unusual design language — as part of its launch, it commissioned generative new-media artist Zach Lieberman to create a piece of art that will continue to evolve over the next 10 years — the anticipated span of the fund. Image Credits: Baukunst

“In a world where most investors had grown scared of technically ambitious products, with nothing more than a simple prototype and a pitch deck, this team saw the potential in Tonal, wrote the first check, and worked to de-risk our business until we were past our Series A,” said Aly Orady, founder and CEO of Tonal, who hit unicorn status last year; Techcrunch did a deep-dive into Tonal as part of our EC-1 series:

“Kate [McAndrew] was Bobbie’s first investor and is now a Bobbie parent. She shares our ambition to use Bobbie as a means of pushing culture forward, including the culture of how we build companies themselves,” shared Laura Modi, CEO and co-founder of Bobbie, who went on to raise a $50 million series B last month.

The team found a Wiedergeburt in Baukunst, leaving behind two of Bolt’s three general partners, Ben Einstein and Greg McAdoo, and elevating the existing Bolt investment team to general partners in the new fund, which lists Tyler Mincey, Matt Thoms, Axel Bichara and Kate McAndrew as its equal general partners.

According to its SEC filing, the firm’s first fund will weigh in at $100 million.

Full disclosure; I was the director of Portfolio at Bolt until 2019. I have no financial interest in Baukunst.

Pingback: ecstasy drug bust,

Pingback: 다시보기

Pingback: 토렌트

Pingback: Online medicatie kopen zonder recept bij het beste Benu apotheek alternatief in Amsterdam Rotterdam Utrecht Den Haag Eindhoven Groningen Tilburg Almere Breda Nijmegen Noord-Holland Zuid-Holland Noord-Brabant Limburg Zeeland Online medicatie kopen zonder r

Pingback: Pinterest

Pingback: BAUC

Pingback: fazele lunii 2024