US stocks fall as investors await Big Tech earnings | Financial Markets News

U.S. equities declined at the start of a busy week for corporate earnings as investors are closely watching results for insights into the effect of inflation and consumer spending as the Federal Reserve steps up policy tightening.

The S&P 500 and Nasdaq 100 slipped more than 1% after Monday’s choppy gains. General Electric Co. slid after saying 2022 profit would be near the low end of forecasts on supply chain woes. Twitter Inc. fell after Elon Musk sealed a deal to buy the social-media platform. Meanwhile, Treasuries, the dollar and oil prices all rose, with West Texas Intermediate futures rebounding from a 1.5% drop earlier in the session.

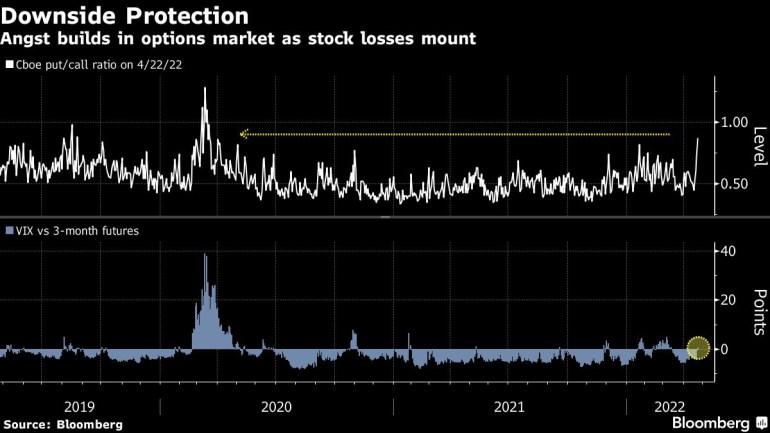

The prospect of slower economic expansion alongside persistent inflation is leading to a febrile mood in markets. The panoply of risks spans the pandemic, supply-chain disruptions, Fed tightening and Russia’s grinding war in Ukraine. The search for portfolio buffers in the U.S. is evident in the highest relative cost of loss-protecting put contracts in two years.

“It’s a question of what’s monetary policy going to look like and it’s super unknown,” Nancy Davis, chief investment officer at Quadratic Capital Management LLC, said on Bloomberg Television.

U.S. corporate earnings are providing some solace for equity bulls — close to 80% of firms have beaten profit expectations including GE, United Parcel Service Inc. and Pepsico Inc. However, disappointing earnings forecasts, including those from JetBlue Airways Corp., are weighing on shares. Results from Microsoft Corp., Google parent Alphabet Inc. and Visa Inc. are still to come.

“This will be the busiest week of reports for the first quarter earnings season,” Art Hogan, chief market strategist at National Securities, said in a note. “This should provide investors an opportunity to shift their focus from the macro headwinds like inflation, the Fed, China lockdowns, and the war in Ukraine, and allow them to disseminate corporate results to ascertain if appropriate valuations have been ascribed in the wake of the markets’ April drawdown.”

China Boost

Stocks in Europe climbed as China’s pledge to boost monetary-policy support for its Covid-hit economy lifted sentiment, while traders also eyed a raft of earnings reports from some of the region’s biggest companies.

The Stoxx 600 Europe rebounded from a six-week low, with Novartis AG and UBS Group AG among the biggest index movers after positive first-quarter reports. Basic resources led the advance, buoyed by earnings beats from paper maker UPM-Kymmene Oyj and ball-bearing manufacturer SKF AB.

Aside from vowing more assistance, the People’s Bank of China also said it will promote healthy and stable development in financial markets. Most of Beijing is being tested for the virus, fanning fears of an unprecedented lockdown there that could drag on global growth.

An Asia-Pacific equity index eked out a climb for the first time in four sessions amid a 3% jump in technology shares in Hong Kong. Mainland Chinese bourses dipped but avoided the kind of plunge witnessed Monday. The yen pushed higher amid short covering.

Fears over the lockdowns have weighed heavily on market sentiment, but concerns over the inflationary pressure may be overblown, Dennis DeBusschere, founder of 22V Research, said in a note.

“There are no compounding supply chain pressures from other important supply chain countries like in 2021,” he said. “There is softer consumer demand in general, service spending is recovering (moderating goods spending) and the USD is moving higher.”

What will be the 2022 peak in U.S. 10-year yields and in which quarter will it happen? And what rock or pop song best encapsulates Fed monetary policy? Get involved in this week’s MLIV Pulse survey by clicking here. Participation takes one minute and is anonymous.

Events to watch this week:

- Tech earnings include Alphabet, Meta Platforms, Amazon, Apple

- EIA oil inventory report, Wednesday

- Australia CPI, Wednesday

- Bank of Japan monetary policy decision, Thursday

- U.S. 1Q GDP, weekly jobless claims, Thursday

- ECB publishes its economic bulletin, Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1% as of 9:50 a.m. New York time

- The Nasdaq 100 fell 1.6%

- The Dow Jones Industrial Average fell 0.9%

- The Stoxx Europe 600 rose 0.3%

- The MSCI World index fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.4% to $1.0673

- The British pound fell 0.5% to $1.2676

- The Japanese yen rose 0.8% to 127.09 per dollar

Bonds

- The yield on 10-year Treasuries declined eight basis points to 2.74%

- Germany’s 10-year yield declined two basis points to 0.82%

- Britain’s 10-year yield declined three basis points to 1.81%

Commodities

- West Texas Intermediate crude rose 1.1% to $99.61 a barrel

- Gold futures rose 0.6% to $1,907.30 an ounce

–With assistance from Joanna Ossinger and Robert Brand.