Can recurring revenue financing drive growth in a turbulent market? – TechCrunch

As the saying goes, “Everyone is selling something.” Sometimes, we forget that when it comes to fundraising. The trick is to sell something investors really want.

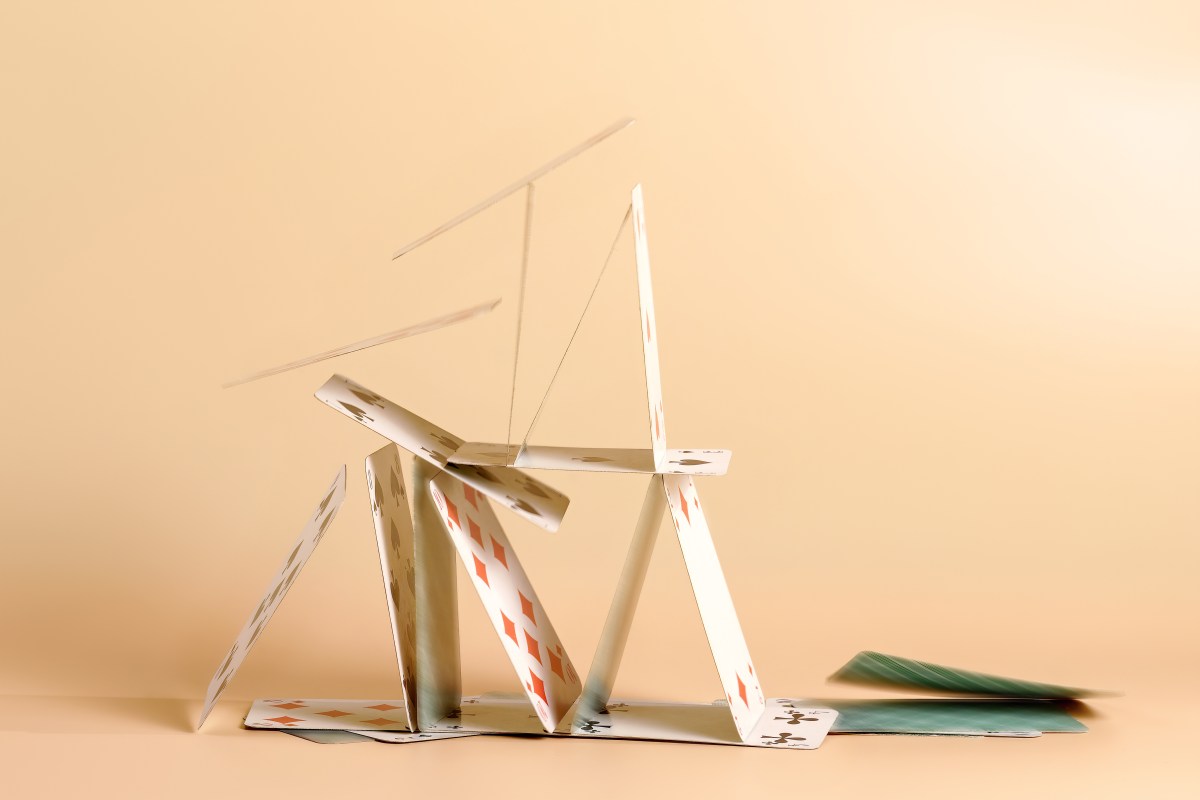

You can sell a piece of your company to a VC, but in a down market, it’s going to be worth less than it should be (and less than it might be in six to 12 months). You can even sell the promise of payment with interest to a lender, but you’ll probably have to accept higher rates, restrictive covenants and possibly warrants to outsell the other debt they can buy.

But your revenue is the one asset you can sell that gives the predictable, stable, de-risked returns investors are looking for in a market full of uncertainty.

Recurring revenue financing (RRF) isn’t just a new package for lending, it’s a whole new model for financing a company, and that’s crucial. A loan based on your revenue is still a loan tied to policy-driven interest rate changes. Recurring revenue financing treats your revenue as a tradable asset, which you then sell to investors.

By selling future revenue streams to investors for up-front capital, they get a steady return and you get to grow faster based on your already booked revenue, taking advantage of big opportunities and the time value of that capital as you scale.

Through live data connections, RRF evaluates your recurring revenue streams to determine their risk level. Investors use that risk level to bid anonymously on your future revenue, which allows you to get the most capital and the lowest cost. And unlike a weeks or months-long due diligence process for a loan or equity round, the algorithm can assess your live data in real time.

For businesses with recurring revenue streams, this is a flexible way to finance growth when VC and loans aren’t an ideal or accessible option. It can also be a great tool to use in addition to equity financing. By leveraging your recurring revenue, you can strategically enter your next equity round when the timing is right for optimal results.

How founders are using RRF

Now that we’ve seen what RRF is and isn’t, let’s talk about how founders are using it to grow businesses. RRF has some major benefits over traditional financing that make it an incredibly agile source of financing.

Pingback: empresa informática

Pingback: 호두코믹스

Pingback: Sams Club