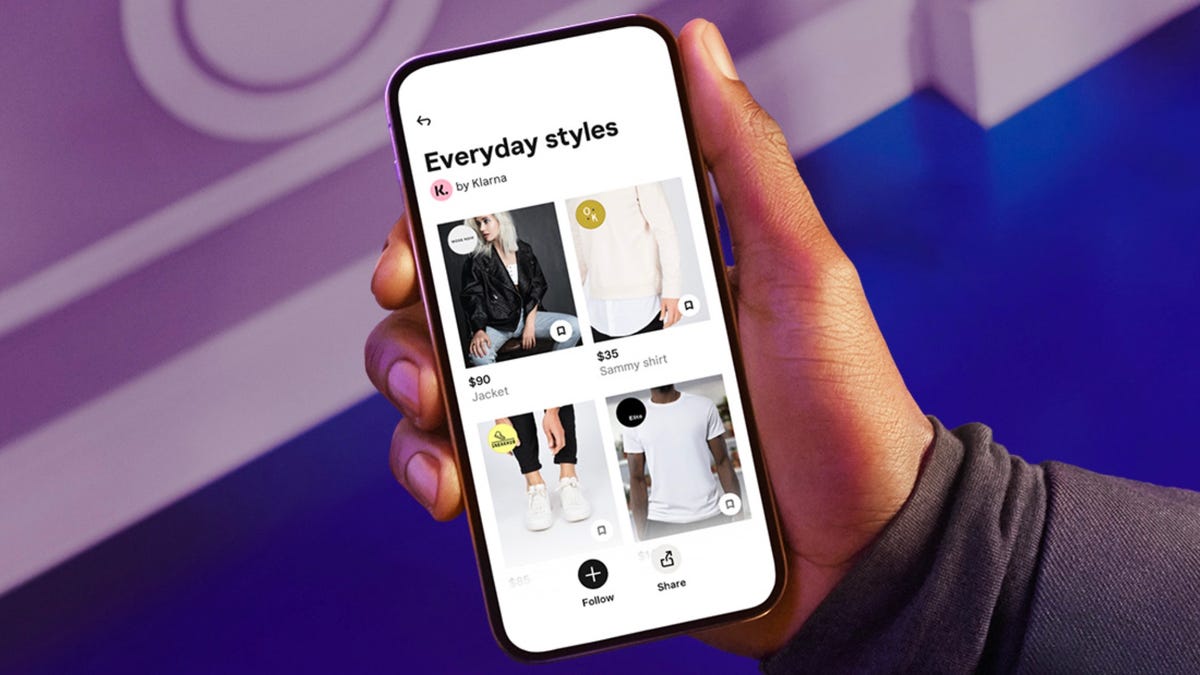

The 6 best buy now, pay later apps of 2022

If you’re considering using a buy now, pay later app, it can be difficult to know which is right for you. After all, they all serve a similar purpose but have some critically different features. Here are a few questions to ask yourself when choosing the right buy now, pay later app for you:

What is your credit history like?

If you have poor credit, then you may be better off choosing a service that doesn’t require a credit check. In fact, you may be best served by one that reports to the credit bureaus to help you build your credit. Perpay is a good example of such a service.

How much are you spending?

Each buy now, pay later app has its own spending limits, and for larger purchases, you may be more limited in which you can use. Certain apps, such as Affirm, are specifically designed for larger purchases.

How quickly can you pay it off?

Certain buy now, pay later apps only allow for six-week payment terms or charge interest on longer payment terms. Consider how long you need to pay off your purchase and whether you’ll be charged interest during that time.

Where are you shopping?

Each of the buy now, pay later apps on our list is only accepted at certain retailers, so be sure to choose a service that is compatible with the retailers you plan to shop at.