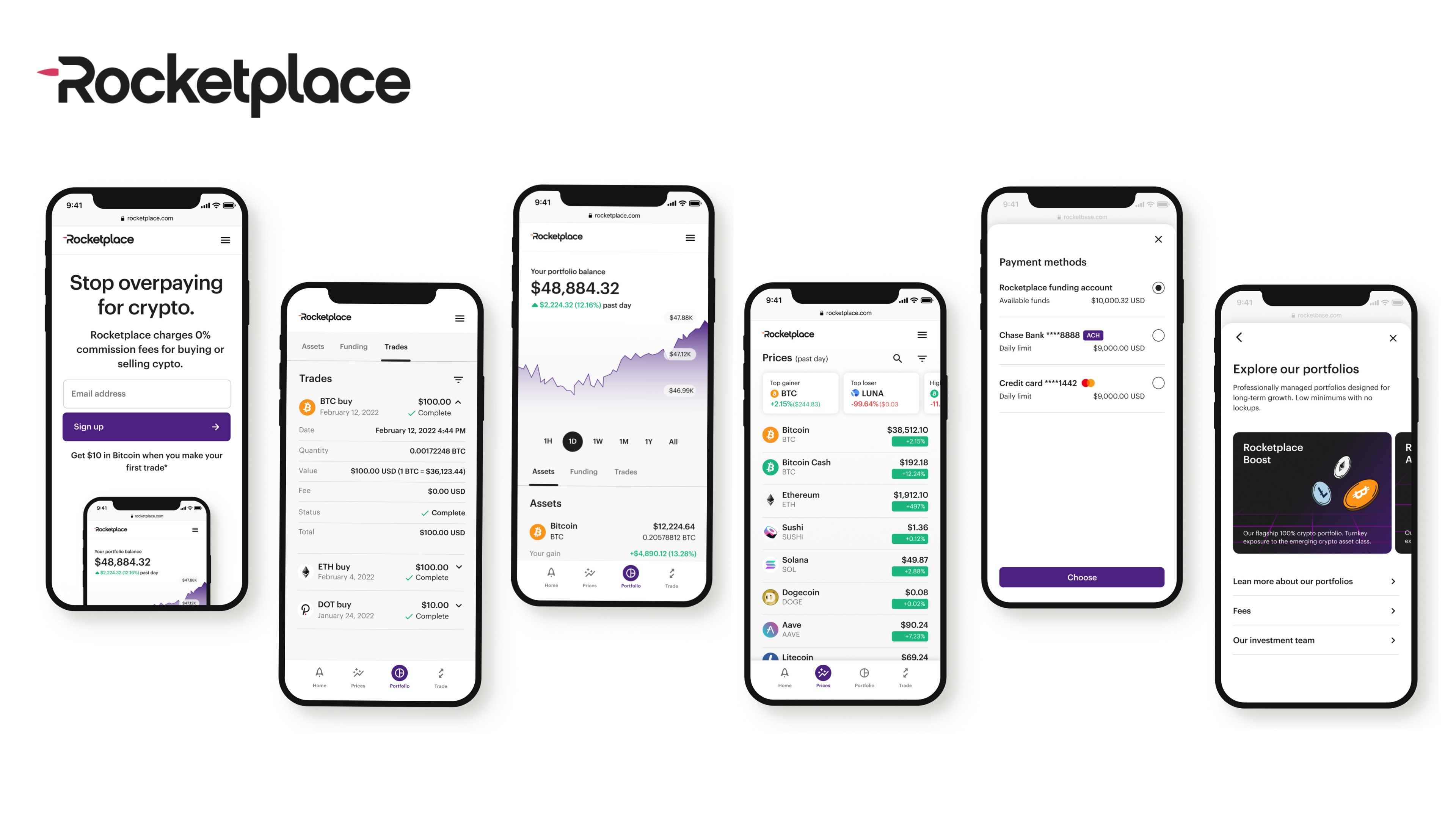

Rocketplace raises $9M in seed funding to build the ‘Fidelity for crypto’ – TechCrunch

Rocketplace, a startup that aims to build a “next-generation asset management platform for crypto,” has raised $9 million in a seed funding round.

A few things about this raise stood out. For one, the funding comes at an interesting time in the crypto world — during the so-called “crypto winter” and a period that has seen other major players in the space such as Voyager and Celsius go bankrupt and others such as Robinhood and Coinbase conduct mass layoffs. Secondly, Rocketplace — which offers commission-free trading of more than 30 tokens — claims to “not be just another crypto exchange.”

It wants to go a step further by making fund distribution and management the center of its offering. This is based on the belief that there will be an “explosion” of new digital financial products offered in the crypto space, and that all of those products will need distribution.

Meanwhile, points out CEO Louis Beryl, customers will need appropriate disclosures and compliance, especially as regulation increases in the industry.

Also notable is the track record of the founding team.

Beryl and Ben Hutchinson (COO) previously built online lender Earnest together. That company sold to Navient in 2017 for about $155 million. Beryl was also a partner at both a16z and Y Combinator, and also founded Solid Energy Systems, which went public via a SPAC merger on the NYSE earlier this year.

Launchpad Capital led Rocketplace’s seed round, which also included participation from TTV, Accomplice, Menlo Ventures and Soma Capital. Accomplice led its pre-seed round, which totaled $8 million across two tranches and included checks from Launchpad and Better Tomorrow Ventures.

“If you think about, in traditional finance, Fidelity’s business model, there are two big areas — retail and institutional,” Beryl explained. “Within retail, you have customer accounts which allow for the buying and selling of stocks and bonds. But on the other side of the business, you have fund distribution. Fidelity started to create its own funds as well as partner with funds created by competitors.”

The brokerage then built a business around fund custody and administration.

“We’re building a similar business, with a similar ethos,” Beryl added. “And we’re building it on top of an extremely low-cost, high-quality, self-service digital asset platform.”

Because Rocketplace doesn’t charge commissions, it is able to buy as its volume scales. It makes money via a small spread between the price that a buyer is willing to pay (bid) and a price that a seller is willing to sell at (offer).

But Beryl maintains that the startup’s biggest differentiator lies in the fund distribution model.

“What I believe is going to happen in the crypto space, which is very similar to what we have seen happen in traditional finance, is you start seeing this proliferation of financial products that investors can invest in — imagine an index in you know, like Vanguard has created,” he told TechCrunch. “So those types of products come in all shapes and sizes, sometimes they’re bullish the market, sometimes they’re bearish the market…my belief is that we’re going to start to see an enormous proliferation of those in the crypto asset class.”

So, what Rocketplace is building, Beryl added, is the distribution of those products “so that retail investors can evaluate those products, invest in those products, get the appropriate data and tax information on those products and actually, really importantly, get the appropriate regulatory and compliance and disclosure framework for those products. None of that exists today.”

He points to the bankruptcies of Voyager and Celsius as evidence of the need for more transparency around performance and more “appropriate” disclosures.

Image Credits: Rocketplace

Currently, Rocketplace has 10 employees, and it plans to use its new capital in part to double its team over the next six months. The majority of the capital will go toward launching its fund distribution business.

Ryan Gilbert, founder at Launchpad Capital, said his firm is “excited to partner” again with Beryl and Hutchinson. (Gilbert also backed the pair’s previous venture, Earnest, while at another VC firm, Propel).

“Fund distribution and fund management is central to the Rocketplace offering, and timing couldn’t be better,” he told TechCrunch via email. “We’re anticipating an explosion of new digital financial products in the crypto space, and these products need compliant, well-managed distribution.

Gardiner Garrard, co-founder and managing partner at Atlanta-based TTV Capital, said his firm is “acutely aware that crypto is a fundamental part of the financial future” and was drawn to Rocketplace’s mission to make crypto “more accessible for all.”

“A key part of the Rocketplace vision is the human aspect of crypto — making the asset class more approachable, intelligent and transparent,” Garrard told TechCrunch. “While most crypto platforms are designed to be transactional in nature, Rocketplace was built to offer a holistic, user-first experience. The Rocketplace team has the opportunity to build an enduring brand akin to Fidelity or Charles Schwab in traditional financial services.”

Pingback: Devops consulting services

Pingback: click for info