CVCs involved in more than a quarter of deals so far in 2022

Last year’s record-breaking venture funding totals were fueled by crossover investors ranging from hedge funds to private equity firms. When market conditions soured at the beginning of 2022, most people assumed that all the nontraditional venture backers would retreat this year as well.

That hasn’t happened.

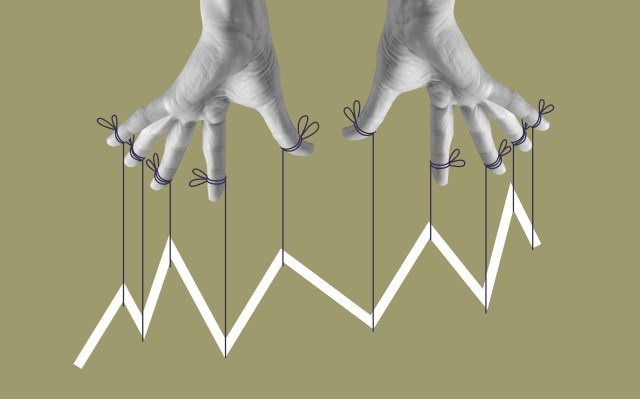

As venture capitalists and tourist investors have pulled back, CVCs have continued to grow their presence and stake in venture deals.

According to PitchBook data, CVCs have been involved in 2,275 deals, collectively valued at $81.5 billion, this year through the third quarter. While this year isn’t on track to match 2021’s record CVC participation in terms of capital invested — $151.6 billion — 2022 has already passed 2020’s prior record of $78.1 billion.

But what is most interesting from the Q3 data is the fact that the percentage of deals that include a corporate investor is at a record high so far in 2022. More than a quarter of U.S. venture deals this year, 25.6%, included a corporate backer, up an entire percentage point from 2021.

Pingback: ทดลองเล่นpg

Pingback: yamaha jet outboard

Pingback: dk7

Pingback: ข่าวกีฬา

Pingback: Webb Schools Palestinian Resistance

Pingback: University of Bilad Alrafidain

Pingback: 토토 안전한 사이트

Pingback: pgslot168

Pingback: https://eltelevisero.huffingtonpost.es/2014/10/memoria-de-humor-vecina/

Pingback: pg168