Inflection raises $40 million for its second crypto-focused fund – TechCrunch

Early-stage venture firm Inflection has raised a new found to invest into the “open economy”, as the firm says in its investment thesis. With that term, the firm means that it plans to cover all things crypto, web3 and blockchain with its new $40.7 million fund.

Limited partners in the Mercury Fund include Accolade Partners, Evanston Capital, Isomer, Hutt Capital, Multiple Capital, Christian Angermeyer’s Presight Partners, Galaxy Digital, DCG, Rockaway, Marc Andreessen, Chris Dixon, Bo Shao and Erik Voorhees.

Inflection plans to write the first VC check for new crypto projects — the investment could range from $0.5 million to $1.5 million. While the firm has put together a traditional fund denominated in USD, it plans to deploy its capital in different ways. In addition to traditional equity rounds, Inflection also plans to buy tokens in private sales but also bet on some cryptocurrencies by buying publicly listed crypto assets.

Inflection has been around for a few years already. It hasn’t disclosed the size of its initial fund, but it has been fully invested already. Some of the investments from fund 1 include popular automated market maker Balancer, decentralized Git platform Radicle, and privacy-focused Notion alternative Anytype.

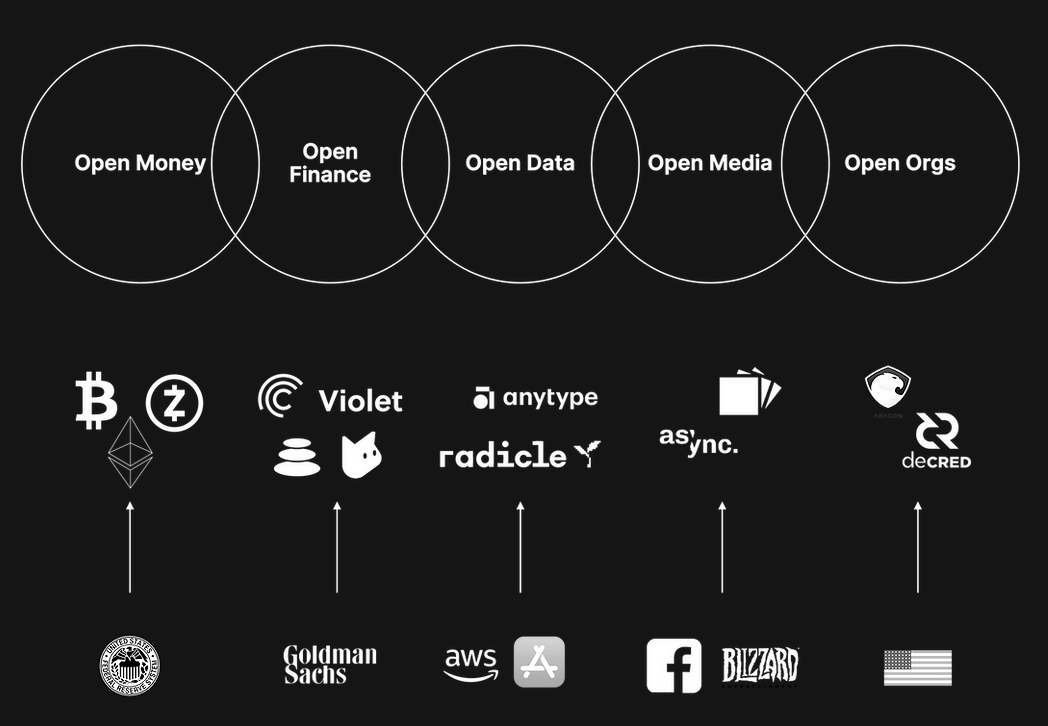

Inflection has already started investing with its new Mercury Fund as well. Portfolio companies include Unstoppable Finance, Violet, Defined and Catalog. Interestingly, Inflection defines the open economy as six different verticals — open money, open finance, open data, open media and open orgs. Here’s what it looks like in a chart:

Image Credits: Inflection

While the Inflection team is still relatively small with only four full-time team members, the firm doesn’t plan to just sign checks. “We run nodes, govern crypto networks, write code and scale DAOs,” the Inflection team writes on its website. It’s interesting to see how crypto-native VC firms differ from traditional VC funds in this description.

Alexander Lange is the founder and general partner of the firm. Jonatan H. Luther-Bergquist acts as the head of research for the firm. Both of them are based in Germany, but some of the team members are also based in Boston. Inflection talks with European companies first but doesn’t exclude global investments.

Pingback: click here to investigate

Pingback: โฉนดที่ดินเข้าธนาคาร ไหนดี

Pingback: chicken road game casino