Flipkart founder’s Navi files for $440 million IPO – TechCrunch

Sachin Bansal’s Navi Technologies, a fintech startup that lends to and offers insurance to customers, has filed for a $440 million IPO as the 40-year-old entrepreneur who made his money by kick starting the e-commerce wave in the country once again makes a bold choice.

Navi Technologies’s initial public offering will consist entirely of new shares, and the startup may consider raising a pre-IPO placement, it said in its draft prospectus filed with the local regulator Saturday.

The IPO comes at a time when tech stocks – or most others – have plunged in recent months. All tech startups including Zomato, Paytm, Nykaa and PolicyBazaar that went public last year have traded at their lowest share prices in recent weeks.

But for Navi Technologies, which has been eyeing an initial public offering for more than a year, there’s also a sense of urgency in making the company public. The startup’s most recent attempt to raise money from SoftBank and other investors at over $4 billion valuation crumbled following its inability to secure a license to become a bank, according to two people familiar with the matter.

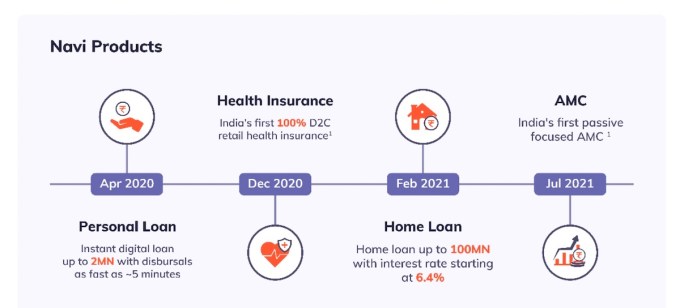

Founded in 2018, Navi offers digital personal loans, home loans and credit against property in the lending space. It also provides customers with health insurance and digital asset management with a passive fund focus.

Billionaire Bansal, who co-founded Flipkart over a decade ago and was pushed out of the company before its sale to Walmart, and Navi have largely stayed off the limelight. The draft prospectus (PDF), for the first time, offers color on Navi’s various businesses and its financial health.

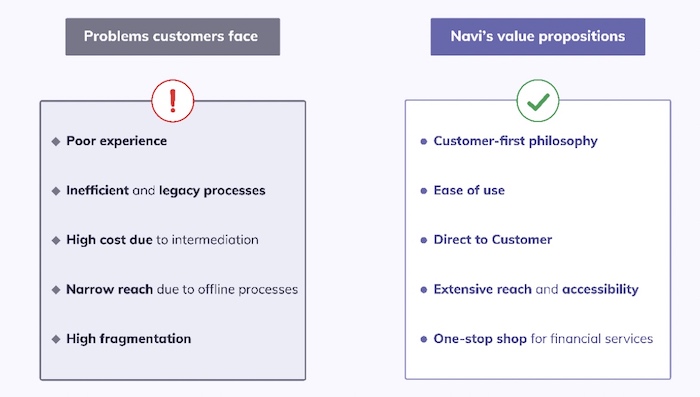

“With its in-house NBFC (non-banking lender) arm, AI/ML-based underwriting and digital-only D2C approach, Navi has been able to exercise control over its lending products from sourcing, underwriting to the collection and offer a smooth experience to customers,” the startup describes itself in the draft prospectus.

Navi says it is using technology to serve customers who have not been served otherwise. The startup ensures “instant loan disbursals, offer digital home loans at low-interest rates, leverage technology to manage fraud and credit default risks, use data analytics to train its lending algorithms to offer attractive pricing and better loan account management and exercising both digital and field collections to its advantage.”

Navi’s value preposition, in its own words

The startup – which has reported a consolidated profit of $9.2 million in FY21 on revenue of $17.8 million – says its personal lending and retail health insurance products are helping customers sign up in less than 4.5 minutes and 2.5 minutes, respectively.

In 21 months since its launch, Navi’s personal loans business has served over 481,000 customers in 84% of Indian zip codes and extended 2 million Indian rupees to them with up to 84 months of tenure. The ticket size of these loans is $665.

“As of December 31, 2021, 61.17% of our health insurance policies sold were approved without any human assistance on the Navi App. Further, we have developed our chat-based interface which ensures that our customers are served seamlessly throughout their buying journey,” the startup adds.

“We offer health insurance premiums through EMIs, where a customer can pay a fixed amount every month towards their policy has made our products attractive and affordable. During the nine months ended December 31, 2021, our GWP was ₹667.60 million, of which ₹63.26 million was from the retail health insurance segment. During the nine months ended December 31, 2021, we had issued a total of 220,491 insurance policies of which 27,800 were retail health insurance policies.”

Pingback: 스포츠 분석

Pingback: best models

Pingback: my profile

Pingback: ปั้มไลค์

Pingback: fortune ox bet