US stocks rise as robust tech earnings calm jitters | Financial Markets News

Traders are weighing strong corporate earnings against data showing the US economy contracted last quarter.

U.S. equities rose as traders considered the strength of corporate earnings against data showing the American economy unexpectedly shrank last quarter.

The technology-heavy Nasdaq 100 climbed 2%, paced by gains in Meta Platforms Inc. after its main Facebook social network added more users than projected. PayPal Holdings Inc. rose on better-than-expected revenue while Qualcomm Inc. led U.S. chip stocks higher. The S&P 500 advanced 1.3% and the Stoxx Europe 600 Index added 0.7%.

Thursday’s relief rally punctuates a week of nerves marked by China’s struggle to suppress Covid, Russia’s war in Ukraine and worries that Federal Reserve monetary tightening may tip the U.S. economy into a recession.

“The earnings season overall has delivered more good news than bad, and could help shift investors focus from the macro headwinds that have battered the major indexes this month,” said Art Hogan, chief market strategist at National Securities. Of the 140 S&P 500 companies that have reported to date, 77% have beat their earnings estimates and 65% of the reporters have raised guidance for the full year, driving up overall earnings expectations for S&P 500 members, according to Hogan.

Results from Amazon.com Inc. and Apple Inc. due Thursday will be closely watched given their outsized influence on U.S. stock indexes. Twitter Inc., in one of its last earnings reports before Elon Musk takes the company private, missed analysts’ estimates on revenue, reflecting a slowdown in advertising.

A contraction in gross domestic product data, the first since 2020, could be a worrying sign for traders as a ballooning trade deficit and softer inventory growth is undercutting an otherwise solid consumer and business demand picture.

It’s “not a strong departure point for the real economy that will be facing a far tighter monetary policy backdrop as the Fed proceeds with rate hikes,” BMO’s Ian Lyngen wrote of the first quarter GDP print. “The Fed has only delivered a single 25 bp hike.”

Treasuries reversed gains, with the yield on the 10-year benchmark climbing to about 2.84%.

Oil prices were little changed, with West Texas Intermediate futures wiping out earlier advances to trade over $101 a barrel.

And in currency markets, the yen’s plunge to a 20-year low could signal a rewrite of the global currency playbook. The offshore yuan sank, the euro retreated along with the pound, and the ICE dollar index hit a two-decade high.

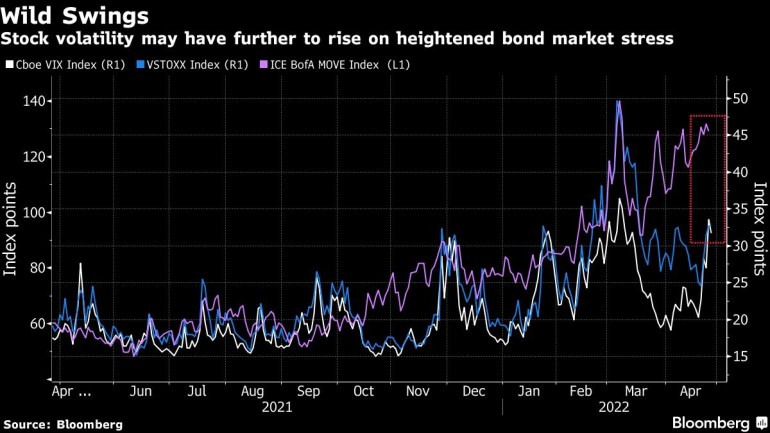

The Nasdaq’s average daily move over the last 100 trading days reached close to 1.6%, the highest such reading since the early days of the pandemic, according to Bespoke Investment Group. There have only been four other periods that averaged such daily volatility — besides the pandemic, they include the dot-com bust, the 2008 crisis and 2011. “Volatility like we have seen in the last four months doesn’t come around very often,” Bespoke strategists wrote in a note.

In Europe, natural gas prices declined following two days of gains as buyers considered options to keep getting supply from Russia without violating sanctions. European Union members are pushing the bloc to deliver clearer guidance over Russia’s demand for payments in rubles, and Germany has signaled it’s open to a phased-in ban on Russian oil imports.

Events to watch this week:

- Tech earnings include Amazon, Apple

- EIA oil inventory report, Wednesday

- U.S. 1Q GDP, weekly jobless claims, Thursday

- ECB publishes its economic bulletin, Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.9% as of 9:35 a.m. New York time

- The Nasdaq 100 rose 1.5%

- The Dow Jones Industrial Average rose 0.3%

- The Stoxx Europe 600 rose 0.5%

- The MSCI World index rose 0.8%

Currencies

- The Bloomberg Dollar Spot Index rose 0.7%

- The euro fell 0.6% to $1.0498

- The British pound fell 0.9% to $1.2435

- The Japanese yen fell 1.8% to 130.70 per dollar

Bonds

- The yield on 10-year Treasuries advanced one basis point to 2.84%

- Germany’s 10-year yield advanced nine basis points to 0.89%

- Britain’s 10-year yield advanced five basis points to 1.86%

Commodities

- West Texas Intermediate crude fell 0.3% to $101.71 a barrel

- Gold futures fell 0.1% to $1,886.80 an ounce

–With assistance from Isabelle Lee, Cecile Gutscher, Charlotte Yang, Macarena Munoz, Andreea Papuc and Kat Van Hoof.

Pingback: go to this website

Pingback: buy Viagra online