Wells Fargo revamps Intuitive Investor platform for new generation of investors

Source: Wells Fargo

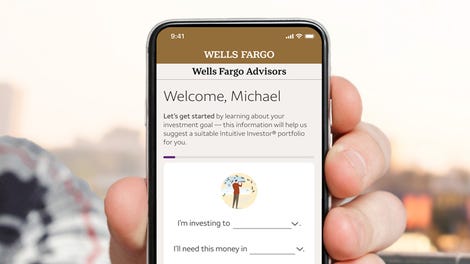

Wells Fargo announced Tuesday that it is relaunching its Intuitive Investor platform with updated features designed to entice new investors and younger generations into the investing world.

The new features include a lower minimum deposit of $500 – down from $5,000 – expanded access to globally diversified portfolios, and a streamlined digital experience. Wells Fargo recently rebuilt its mobile app to be more intuitive, and investors can access the robo-advisory platform within it. Consumers looking to sign-up as Intuitive Investor customers are required to have a Wells Fargo checking or savings account.

Robo-advisory platforms manage portfolio investments on behalf of the investor. In addition to the robo-advisory Intuitive Investor platform, Wells Fargo has the WellsTrade platform, where investors can make investments on their own behalf.

Included in the expanded global portfolio selections are portfolios that are influenced by environmental social & governance (ESG) which means they are focused on sustainability.

Additionally, new investors will be able to open an account easily through the relaunched mobile platform. Customers will also get a discounted price of 0.30% annual advisory fee when they link their Wells Fargo Bank Prime Checking, Premier Checking or Private Bank Interest Checking account with premium benefits to their Intuitive Investor account. The standard annual advisory fee is 0.35% of an investor’s return.

According to Michelle Moore, executive vice president and head of consumer digital at Wells Fargo, the company has paid special attention to making account creation faster and easier for clients. She told ZDNet that the account creation process has been simplified from about 40 screens to 16, cutting the time it takes to sign up in half.

During the account creation process, prospective investors will be asked a series of questions. Investors will be asked about their goals, their risk tolerance, whether they prefer diversified portfolios, and what actions they would like Wells Fargo to take in accordance with market fluctuations. Based on the provided information, the Intuitive Investor platform will suggest a number of portfolios to choose from, including the newly added ESG portfolios.

With an emphasis on an easier, mobile experience, Wells Fargo hopes to attract Gen-Xers, Millennials, and younger investors. As such, it’s important for the company to include financial literacy resources to help inform new investors who may not be familiar with diversified portfolios, risk tolerance, or market fluctuations.

Investors can take advantage of Wells Fargo Investment Institute which offers consumers a wealth of information covering investing, wealth management, banking, inflation and interest rates, among others. Moore also said additional features will be added to Wells Fargo’s investment platforms by the end of the year, including insights, guidance, and deeper personalization.

Once the account is created, the investor can log in and set up recurring deposits to their investment account and check how their portfolios are performing. And although it is a robo-advisory platform, Moore said that clients can contact advisors for help if needed.

It’s important to note that, while $500 is the minimum initial investment, according to Wells Fargo, clients must maintain an investing account balance of at least $100. The company runs a balance check quarterly, and if the account is below $100, clients will have 30 days to bring up the balance.

According to the company, 87% of Millennials stated that they are looking for a mobile app experience that rivals a website experience. The relaunch of the robo-advisory investment platform is part of Wells Fargo’s continued effort to create a simple and easily accessible digital experience for its clients.

Also: Linqto seeks to make investing in private tech companies more accessible

“We have simplified the Intuitive Investor platform to create a faster and stronger experience for both new and experienced investors,” Barry Sommers, executive vice president and head of Wells Fargo Wealth & Investment Management, said in the press release.

A recent J.D. Power study found that newer investors tend to face more challenges than tenured investors. These issues could come in the form of technical problems or lack of knowledge. Many of the newer investors tend to be younger, and as such have less financial experience.

According to J.D. Power, by offering more financial literacy resources, smoothing out technical hiccups, and by having a greater level of personalization in client experience, investing firms would likely see more loyalty among new investors, and in turn, new investors would feel better supported. Moore said deeper personalization, guidance, and insights will be added to Wells Fargo’s investing platforms by the end of the year.

“We just relaunched wellsfargo.com, the Wells Fargo mobile app, and now we’re doing Intuitive Investor. You’ll see things around Wells Trade, you’ll see news around insights and personalization by the end of the year, so really it’s an overall investment in digital by Wells Fargo to move forward digital and physical together. [Wells Fargo is] trying to find ways to ensure that, however a customer wants to bank with Wells Fargo, we make it a seamless transaction,” Moore said.

Pingback: uniccshop.bazar

Pingback: autodetailing

Pingback: Aviator

Pingback: 1win

Pingback: Mostbet Casino aplikace