Mexico: Inflation hits 21-year high ahead of rate decision | Inflation News

Core inflation, which does not include volatile items like fuel, grew 7.65 percent compared to a year earlier, Mexico’s government said.

By Bloomberg

Published On 9 Aug 2022

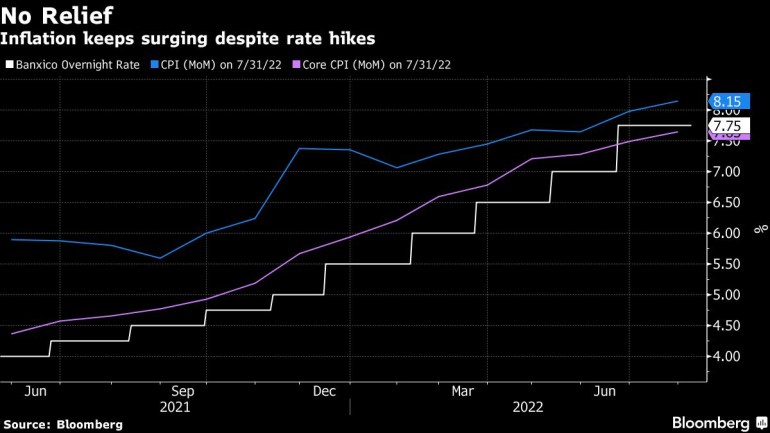

Mexico’s inflation accelerated broadly in line with analysts’ estimates in July to the fastest pace since early 2001, as the central bank is seen delivering a second straight 75 basis-point increase to its key interest rate this week.

Consumer prices rose 8.15% last month compared to a year earlier, slightly faster than the 8.14% median estimate of economists surveyed by Bloomberg, the national statistics institute reported Tuesday. On a monthly basis, inflation slowed to 0.74% from 0.84% in July, versus economists’ median estimate of 0.73%.

Core inflation, which excludes volatile items like fuel, was 7.65% in the same period, above analysts’ median estimate of 7.61%. Inflation has continued surging despite the central bank’s nine straight rate hikes totaling 375 basis points since June last year.

The numbers “continue to be worrying,” said Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa. “They keep rising despite the movements made by Banco de México since June last year.”

Another Big Hike

All 22 analysts surveyed by Bloomberg see the bank, known as Banxico, boosting rates by 75 basis points Thursday. The bank targets inflation of 3%, plus or minus 1 percentage point.

Last month’s 75 basis-point hike was the biggest increase since Banxico started targeting a key rate in 2008. The board, led by Governor Victoria Rodriguez, said it “intends to continue raising the reference rate and will evaluate taking the same forceful measures if conditions so require.”

“Banxico will worry about the large core print. We expect a 75 basis-point hike on Thursday with risks of a 100 basis-point hike,” said Carlos Capistran, Head of Mexico and Canada economics and Bank of America.

The government says it has shaved 2.6 percentage points off headline inflation by spending around $28 billion on measures to tamp down prices this year, including a fuel subsidy and price pact with major food producers. It started to ease spending on fuel subsidies last month as US gasoline prices fell more than 30% from their June peak.

According to a Citibanamex poll published last week, economists see inflation ending the year at 7.74% — up from a previous estimate of 7.68% — with the key rate at 9.5%.

Mexico’s economy outpaced analysts’ expectations in the second quarter, growing 1% versus the previous three months. Gross domestic product is still yet to recover to pre-pandemic levels.

Latin America’s central banks helped prevent a currency crisis by starting aggressive rate hikes last year, which also helped contain inflation by as much as two to three percentage points, Bank for International Settlements head Agustin Carstens told Bloomberg News in June.

The region’s major economies have struggled to keep prices down as Russia’s invasion of Ukraine in late February has sent food and energy costs surging ever higher and as supply-chain troubles that have lasted through the pandemic continue to disrupt businesses.

(Updates with economists’ comments in third and fifth paragraphs.)

–With assistance from Kristy Scheuble.

Pingback: orange hawaiian mushroom for sale magic boom bars where to buy psilocybin capsules for sale

Pingback: 티비위키

Pingback: Fysio Dinxperlo

Pingback: Google Classroom