Kenya ready to privatise 35 companies amid cash crunch, says president | Business and Economy News

Kenya, which passed a revised privatisation bill recently, is facing many challenges including depleted government coffers.

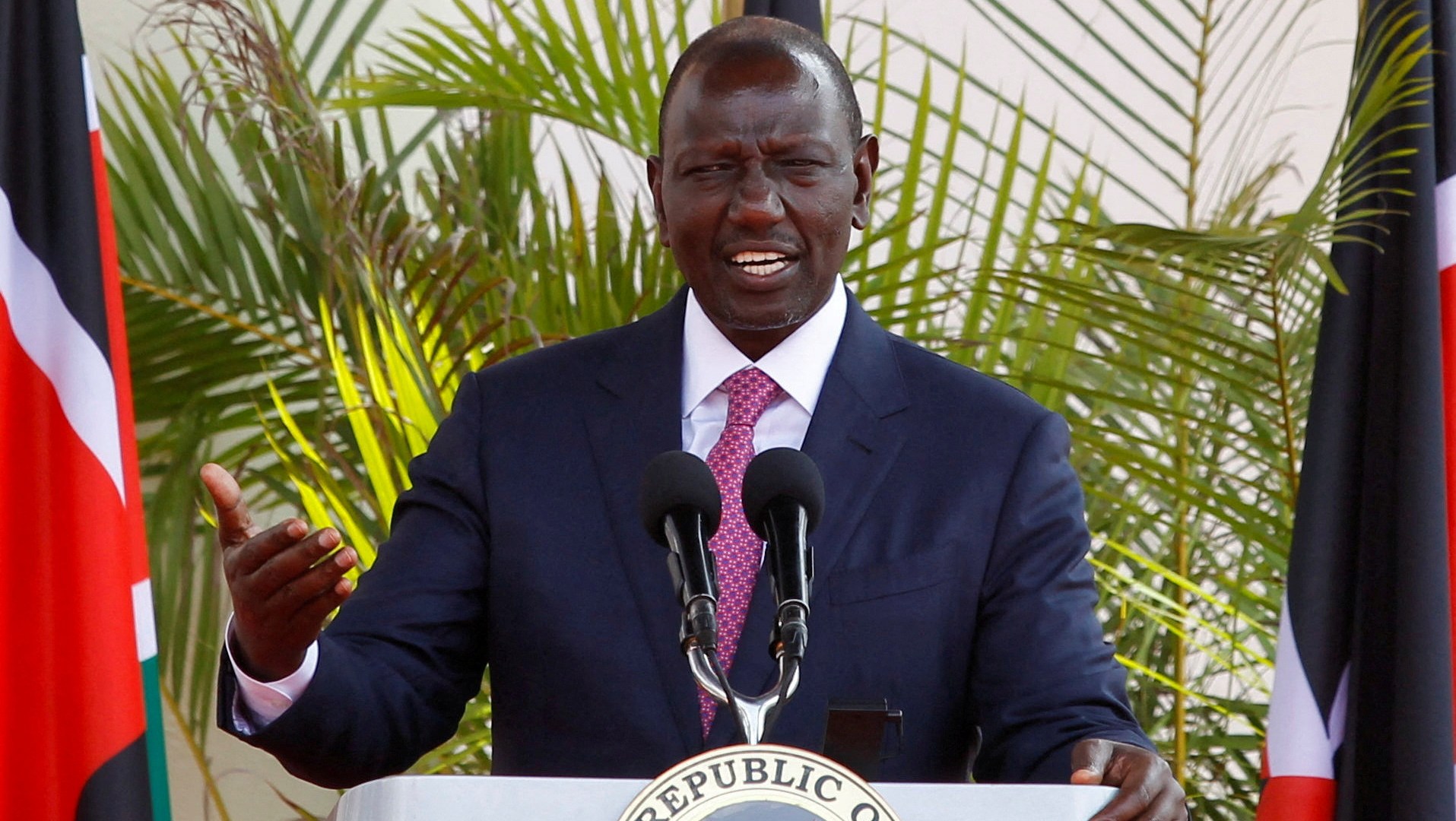

Kenya’s President William Ruto said on Thursday the government was poised to privatise 35 state companies and was looking at a further 100 firms after enacting a revised law last month to cut down on bureaucracy.

“We have identified the first 35 companies that we are going to offer to the private sector,” Ruto told a gathering of African stock market officials in Nairobi.

The law makes it easier to sell state enterprises to private companies and aims to push up the private sector’s participation in the economy, the presidency said at the time of the signing.

Kenya last privatised a state-owned company in 2008 when it issued an IPO for 25 percent of the shares in telecommunications firm Safaricom.

A year later, the cabinet approved a list of 26 firms to privatise including the Kenya Pipeline Company, Kenya Electricity Generating Company, and banks, but no action has yet been taken since.

East Africa’s economic powerhouse is facing a host of challenges, including depleted government coffers, skyrocketing inflation, and a plunging currency that has sent its debt repayment costs soaring.

The International Monetary Fund (IMF) said this month that it had agreed to a $938m loan for Kenya, which also has a $2bn Eurobond repayment due next year.

The IMF also urged Ruto’s government to reform public sector firms, particularly the national electricity supplier Kenya Power and the national carrier Kenya Airways, which suffered record losses in 2022.

On Monday, the World Bank said it expects to provide the country of 53 million people with $12bn in support over the next three years.

Kenya had accumulated more than 10.1 trillion shillings ($66bn) in debt by the end of June, according to the country’s National Treasury figures, equivalent to around two-thirds of gross domestic product.